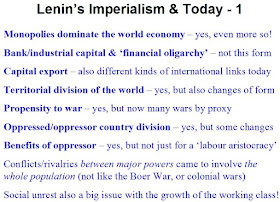

Below are copies of slides from my presentation today to the conference in London on the 150th anniversary of Marx's Capital.

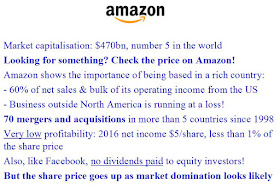

Use them as you wish, but do the decent thing and credit your source if you republish this information elsewhere. The telegrammatic points below are more fully elaborated in other articles on this blog, especially in those on Apple, Amazon and Facebook.

Tony Norfield, 19 September 2017

A fine summary of your argument as developed in the book and on this blog. I have a layman's question.

ReplyDeleteMy understanding of what you've been saying over the past year or so that I've been following your work is that the process of appropriation, circulation and reinvestment is now highly mediated through a very complex financial of system that both reflects and reinforces the current power relations in the international state system. If the standard lay-Marxist understanding of surplus value extraction is that the worker produces a commodity and gets paid less than its value by the capitalist, who then pockets the difference after having sold said commodity on the market, we now have a much more complex relationship and distance (institutional and geographical) between producer and exploiter, as your Apple example demonstrates very well.

Now does that mean that this particular form of the world capitalist system is much more vulnerable to *political* shocks because of this 'distance'? For example, we can imagine a situation where Chinese-American relations deteriorate very rapidly due to the crisis on the Korean peninsula. In an extreme scenario, China could move to seize the productive operations of several American companies, while US capitalists would only be left with titles of ownership to such operations. Now, without looking into the scenario of military confrontation, the US could retaliate by attempting to shut China out of the global financial system, but I wonder, how meaningful could it be to shut out the actual stuff out of their system of circulation? I suppose my bottom line question is, what are the implications for the international capitalist system of the delegation of a lot of (most of?) actual production to a particular state and the domination of circulation/appropriation by a different one?

Reply to YK:

ReplyDeleteThere is a complex division of labour within the world economy. Even in the same sphere of production, for example automotive products, components of the final commodity will be shipped across many national state borders. This makes it difficult for Trump, or anyone else, to shut out goods from the international system of circulation. At the very least, it would disrupt the investments of many capitalists in many countries, not just the ones targeted. Of course, it is easy for Trump to target North Korea. He will have more trouble imposing sanctions on China if its policy does not fall into line.

Major powers dominate the world economy, and the different spheres of production, commerce and finance in that system. The problem is the rival interests of the different states, not geographical distance. How the different states respond to the economic pressures they face, and especially to political sentiment in their countries, will be the source of political ‘shocks’.

These ‘shocks’ illustrate how the former relative calm of imperial power relations (between the major countries, anyway) is now being steadily undermined. The Trump and Brexit phenomena, for example, reflect what happens when popular, reactionary views have a big impact on state policy.

Tony Norfield, 21 September 2017

prof premraj pushpakaran writes -- 2018 marks the 200th birth year of Karl Heinrich Marx!!!

ReplyDelete