Whatever you may think of the

multi-billionaire founders of Amazon and Alphabet-Google, [1]

there would seem to be one undeniable fact about their companies: they have

massively improved productivity. Amazon has an e-commerce system that delivers

very efficiently; Google has revolutionised Internet search. Yes, there is

quite a list of undeniable negative facts too – poor working conditions

in Amazon ‘fulfilment’ centres, the hoovering up of personal data by Google,

how each company’s rise to power has upended the economics of other businesses,

and much else besides. But the productivity benefits of their services seem

unimpeachable. It lies behind Amazon’s increasing share of the consumer market

and Google is now used in around 90% of Internet searches. Nevertheless, a

closer look at these tech giants shows that all is not what it seems.

Productivity and the market

Being more productive is a good

thing, or at least it should be. It means producing with fewer resources – less

time spent working, travelling or waiting to get the same output, using raw

materials and other inputs more efficiently, and so on. In the framework of the

capitalist market, however, this can have all kinds of bad repercussions.

Rather than society being able to be better fed, in better health, with more

leisure and time to enjoy life, the burden of work for some increases while

others are made unemployed, lives are disrupted and the benefits of

productivity go to a few.

Apologists for capitalism may

accept this point, but would argue that the market system encourages all kinds

of innovation and, while there are some unfortunate side effects, in reality it

is only this kind of system upon which progress for society as a whole can be

built. That perspective leaves out many things, not least capitalism’s

propensity for wars and destruction, the monopolisation of the world’s

resources by a few powerful companies and governments, and the oppression of

hundreds of millions of people for whom being part of the capitalist world

economy more often means a ticket for the treadmill rather than a path to

progress.

But I will leave such damning

truths for now. I will also give insufficient attention to how invention is

most commonly a social phenomenon, even one backed by state resources, not a

bright spark from a lone genius. Or how innovation is ever more dominated by rich

capitalist companies that buy into ideas to help them build or sustain a

monopolistic position in the supposedly competitive market. I won’t even

discuss how the slump in Alphabet-Google’s and Amazon’s share prices since the

summer will give them problems with investors, since, like Facebook, they have

a policy of paying no dividends. Instead, I want to uncover the peculiar

features of productivity at two of the Big Tech giants.

Google’s advert stream

Despite Alphabet’s forays into

robotics, artificial intelligence and ride-hailing, the company’s business

still very much depends on advertising revenues from Google.[2]

The non-Google business, termed ‘Other Bets’ in its accounts, generated barely

1% of sales revenues and made a loss of $3.4bn in 2017. By stark contrast, the

Google ‘segment’, including YouTube and other items such as cloud computing,

registered an operating profit of $32.9bn on revenues of $109.7bn in 2017.

Within the Google operation, the

importance of advertising revenues has fallen from around 99% of the total up

to 2007 to around 85% now. This reflects both the company’s increased

difficulties in boosting such revenues and how cloud computing, money from

selling apps and Google Play have become more significant. Even a monopolist

has to diversify! Google’s advertising numbers are nevertheless key for the

conglomerate’s business and are likely to remain so for years to come. Examining

these and other related data brings out important aspects of corporate

productivity – with all the caveats attached to that term indicated in the

previous section.

It is instructive to look at

Alphabet as principally a company that sells adverts. Its ‘output’ is then how

many adverts it sells.

This output can be assessed in

two ways: by simply looking at the advertising revenues and by counting the

adverts themselves. However, there are no figures available for the latter.

Instead, one has to adopt the philosophical view that something only exists

when it is experienced and, in this case, more specifically, when someone

‘clicks’ on the advert. Alphabet goes further than this and, as befits a

capitalist corporation, reports changes in the total number of clicks on the

adverts that a company must pay for. Annoyingly, it does not give totals, only

percentage changes, but it does also note the change in the ‘average cost per

click’, in other words, the average price it receives from the clicks that have

taken place.

Google's Clicks

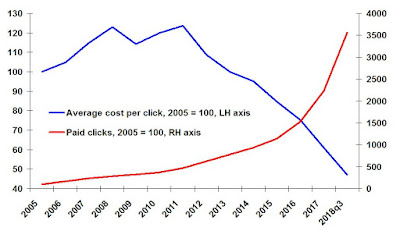

I have trawled through

Alphabet-Google’s accounts and noted the annual changes in the total paid

clicks and the average cost per click since 2005. It was not necessary to go

back any further to bring out the main features, leaving aside the serious

threat to my sense of well-being that this would have entailed. The picture is

clear: a very big rise in paid clicks and a fall in the average cost per click.

So, a huge increase in ‘productivity’, as the volume of output has risen while

the unit cost has dropped.

Of course, selling more adverts

at a lower cost is not what a normal person would call being more productive.

But this is the capitalist market view, not an assessment of what may be good

for society. That view means discarding social values in favour of market

values, where the magic of the market is also responsible for downward pressure

on the prices charged for the adverts. Fortunately for Alphabet-Google, the

result of the more adverts/lower costs trend has been a strong growth in total

revenues from adverts, reaching nearly $111bn in the year to end-September

2018, compared to around $50bn five years before. Unfortunately for the

company, the pace of this revenue growth has faltered in recent years and there

are other metrics more commonly followed by capitalist markets that do not

augur so well for it.

Take another type of

productivity measure, one that compares revenues or operating profits with the

property and equipment assets the company holds. Such assets are the fixed

capital needed to generate the returns, and one would expect that a larger

volume of investment would lead to increased revenues and profits. They do, but

at a slowing pace. This can be seen in how the ratios of revenues and profits

to fixed assets have fallen, as illustrated in the next chart.

At the end of 2006,

Alphabet-Google held $2.4bn in property and equipment assets. Ten years later,

at end-2016, that had multiplied to $34.2bn. By the end of September 2018, less

than two years later, it was more than 60% higher again at $55.3bn. Total

revenues and operating income grew much more slowly, so the lines in the chart

show a fall. A similar picture holds for revenues and income compared to the

company’s expenditure on research and development. Alphabet-Google’s R&D is

very high, at close to $20bn in the year to end-Q3 2018, taking up 15% of

revenues and measured at 76% of operating income. But the R&D expenditures

have also risen much faster than either revenues or income.

Google's Operating Income & Sales Revenues versus Fixed Assets

Amazon’s anomalies

My previous review of Amazon’s

business (here) noted that it had surprisingly

little profit for a burgeoning tech giant, and that much of its growth in sales

revenues and profits had come from its cloud computing arm, Amazon Web Services

(AWS), not from its widely known e-commerce operation. I must admit to

wondering why Amazon had continued to expand outside North America, given

persistent and widening losses. However, the latest data show that these International

losses have finally begun to narrow. They were a little over $2.4bn in the year

to the end of the third-quarter 2018, down from a $3bn loss in 2017. That may

be enough to keep in place Amazon’s ambition to take over the e-commerce world,

although the parcel delivery operation outside the US has so far looked more

like an expensive branding exercise for AWS’s dramatic growth.

Amazon’s operating income

(loss), 2015-2018 ($ million)[3]

2015

|

2016

|

2017

|

Year to Q3 2018

|

|

North America

|

1,425

|

2,361

|

2,837

|

6,708

|

International

|

(699)

|

(1,283)

|

(3,062)

|

(2,419)

|

AWS (Amazon Web Services)

|

1,507

|

3,108

|

4,331

|

6,473

|

Total

|

2,233

|

4,186

|

4,106

|

10,762

|

Amazon’s latest figures show a sharp rise in sales

revenues and operating income. These are mainly from North America, and were

boosted by Amazon’s purchase of Whole Foods Market in August 2017. At the same

time, revenues and income from AWS are continuing to grow very rapidly. It

could also be that the international e-commerce business will finally benefit

from Amazon’s big investments. It will need to in order to turn around what are surprising trends in operations from a company that would

otherwise appear to be the epitome of cost cutting.

Take Amazon’s ‘fulfilment

centres’, for example. These are the enormous warehouses of goods, not only

staffed by low paid workers, but also full of amazing technology and robotics

to optimise selection, packaging and delivery, together with algorithms to

minimise the paths taken. One would expect that the costs of running these would

increase as the sales business expands. But, at the same time, these costs

should not rise as quickly as sales, since economies of scale would kick in.

Nevertheless, Amazon’s accounts show that the costs of these fulfilment centres

have risen faster than Amazon’s net sales. In 2009, fulfilment centre

costs were $2bn, which was 8.4% of net sales that year. The proportion had

risen to 14.2% by 2017, when such costs were $25bn, and it was higher still in

2018.

It would be difficult for a new

entrant into this market to outcompete the Amazon machine. Yet the rising ratio

of costs to net sales revenues raises questions about how productive these

centres really are. Is their efficiency exaggerated in the minds of those who

only see the robots, the disciplined workforce and the smooth running system,

and who ignore what all this costs?

Where some of it happens ...

One reason for the increase in

costs compared to sales revenues is due to Amazon opening lots of extra

fulfilment centres worldwide – see the information on these centres here. This will incur costs before they are fully

operational and generating extra sales. Another reason lies in the distinction

that must be made between a physical, productive efficiency and the value of

the goods delivered. Unfortunately, Amazon provides only sporadic details on

this topic, as on others, so a view cannot be properly verified from data in

their accounts. Nevertheless, the information available suggests both that the

volume of throughput at fulfilment centres – the number of items, parcels, etc,

per day – has risen sharply, and that the cost per item or parcel has fallen

steadily. So, physical productivity has increased, as one would have expected.

That has not been translated

into higher net sales revenues when measured against the costs of these

centres, not only because of the rapid expansion in the number of these

centres, but also because Amazon has reduced the average prices of the goods to

its customers. This might seem a strange thing for a capitalist company to do,

but it is an explicit part of Amazon’s strategy of building volume and

increasing its share of the market.

An example to support the view

that average prices have fallen is that in 2017 the value of consolidated net

sales rose by just over 30%, to $178bn. In the same year, shipping costs rose

by 34% in 2017. The volume of deliveries likely rose by even more than 34%,

given that Amazon continues to pressure delivery companies to cut their fees.

Amazon passes on the costs

This price cutting strategy is a

risk for Amazon’s profits, but that risk is reduced if it can pass on the

pressure to its suppliers! This is something it has been very effective at

doing.

Amazon's Costs as a Percentage of Net Sales

Most of the expenses that can be

measured against net sales – such as the investment in technology, fixed assets

or administration – have been rising, just like those for the fulfilment

centres. One item has not: the cost of sales. This number is principally made

up from what Amazon pays the suppliers of the consumer goods it sells and is

the largest expense item. The cost of sales was $112bn in 2017, 63% of the

total value of consolidated net sales of $178bn. That percentage has fallen

steadily from nearly 78% in 2010, dropping to just 58% in the third quarter of

2018.

This rapid fall in the cost of

sales relative to total sales has kept Amazon’s e-commerce show on the road.

The gap between the two numbers represents Amazon’s gross profit, from which it

can fund other things. It reflects Amazon’s power as a platform for selling

consumer products, a power that has grown dramatically in recent years and

which allows it to force other companies to deliver its goods more cheaply.

Productivity and profitability

Investing more and undertaking

R&D is what one would expect a productive capitalist company to do. What

Alphabet-Google and Amazon may not have expected is that this would go

alongside an increasing difficulty in producing extra revenue and profits. The

two companies work in different ways, but the trend for each is similar. Their

‘output’ costs per item (of adverts or shipped goods) have fallen, but the

scale of necessary investment to bring this about has risen faster than sales

revenues and profits. It is perhaps stretching the interpretation of company

accounts a little too far to see in this a tendency for their rate of profit to

fall as the company multiplies up the scale of investment. Nevertheless, the

figures for Alphabet-Google do show a distinct drop in both operating income

and total revenues compared to its fixed assets.

Amazon's Sales and Operating Income vs Fixed Assets

A similar picture is true for

Amazon (see the previous chart). Between 2004 and 2008, its net sales were more

than 20 times the value of its fixed assets. By 2015, the ratio had fallen to

just five times, hitting a low of 3.6 in 2017. There has been only a minimal

recovery since as Amazon’s sales revenues have jumped by just a little more

than the jump in fixed assets held. In the case of operating income versus

fixed assets, there has also been a trend decline for Amazon. The ratio was 1.8

in 2004, falling to 0.6 in 2010 and 0.1 in 2015. That ratio has also recovered

a bit in the most recent period as profitability improved, but was still only

around 0.2.

Each company is a Big Tech

giant, though Alphabet-Google’s business machine sells advertising slots while

Amazon’s started out only selling more efficiently what others had produced.

Each has tried to diversify operations, using the vast resources made available

to them by their respective monopolistic positions. Each brings out the

peculiar manner in which capitalist corporations boost ‘productivity’, one that

is anti-social, given the effects on society at large. They are part of the

imperialist world market and play a role in its domination of society, but,

unfortunately for them, they cannot escape the constraints on profitability.

[1] The original

Google company was reorganised, and from October 2015 it became part of a

conglomerate, Alphabet Inc. In September 2017, a shell company was set up, XXVI

Holdings Inc. The Google segment of the business remains by far the largest

component of the overall operation, and that will be the main subject of this

article.

[3] Business

accounting definitions can be tricky to follow, but note that Operating Income

is defined as Net Sales minus Operating Expenses minus Stock-based compensation

and other items. Also, Net Income is defined as Operating Income minus

Non-operating income/expense, Provision for income taxes and Equity-method

investment activity, net of tax.

1 comment:

Amazon fascinates me due to the "exorbitant privilege" the capital markets have bestowed on it via the infamous 80x and higher P/E multiple. This means the capital markets are blessing amazon with extra capital despite its lower profit. This is almost conspiratorial in nature in the capital markets......at what point does the buy-side consider it a breach of duty to buy for its clients a company near $ trillion in market cap at a multiple of 80x!??

Then you realize what the "goal" or "end game" of the high P/E is.....Amazon will BE THE global conduit for online purchases of anything, and it will BE the internet (via cloud computing) the world over.

Never mind that the US doesn't manufacture anymore, Stan Shih's "smile" shows there's "value added" to be made at the storefront end!

Also scary, the P/E can be "made whole" (Ie. profits "filled in") at the click of a button: price discrimination-101. IN the future, who is to say the FTC, or regulation of commerce will preclude the same banana being sold to Mr X (who works in highstreet wears pinstripes kids in private school etc) for $3/banana, and to Mr Y( blue collar, public school kids, council flat) for $1/banana. Being able to Fill in the Surplus under the PQ curve accounts for an INSTANTANEOUS, COSTLESS jump in profits by a factor of the order of 2x...! But will society stand for that....pricing based on what Amazon's cookies KNOW about you and your household!

Post a Comment